Check 21 and Its Impact on Businesses

The Check Clearing for the 21st Century Act—the new “Check 21” law that goes into effect on October 28, 2004—will require only moderate preparations by businesses.

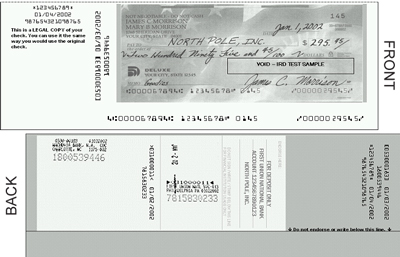

Basically, Check 21 addresses how banks process checks. It legalizes a new negotiable document that includes an image of the front and back of the original paper check. This “substitute check,” also referred to as an “image replacement document” (IRD), can be processed in the same manner as the original check and is considered its legal equivalent. A copy appears below:

The legislation requires banks to accept and process substitute checks for consumer, corporate and government checks, but not foreign checks.

Beginning on October 28, 2004, rather than transport and present the original checks to the paying bank for payment and settlement, a depository bank, and any subsequent transferring bank, will have the option to present substitute checks.

The catalyst: 9/11

Check 21 aims to improve check-clearing efficiency by reducing the clearing system’s need to physically transport the original check from the point of deposit to the original paying bank.

The 9/11 terrorist attacks on the United States in 2001 caused air transportation delays that resulted in billions of dollars in suspended check clearings. In the aftermath, Congress passed Check 21 to reduce the payment system’s dependence on the physical transportation of checks—and to aid in reducing the associated risks and costs.

A few preparation steps

The impact of the October 28 implementation of Check 21 should be minimal for Cole Taylor customers. However, we do recommend the following steps to ensure your organization’s readiness:

Educate your employees about substitute checks.

After October 28, Cole Taylor customers, who currently receive images of the front of their original checks with their monthly statements, may receive some images of the front of substitute checks instead. Substitute-check images will appear a bit smaller and will be in the substitute check format shown above.

In particular, be sure that staff involved in fraud prevention, research, collections and reconcilement are familiar with substitute checks and the legal equivalence requirements. The proper education will enable your staff to make informed decisions and continue to perform their tasks efficiently.

Evaluate your company’s check stock to confirm that it produces high-quality images.

Whether you print your own checks or purchase check stock from an outside vendor, you may want to ensure that your stock is image-compliant and of high quality. Otherwise, you might receive illegible substitute checks that would have little value for research or proof-of- payment purposes.

Consider potential fraud prevention implications.

Some check stock security features designed to deter fraud, such as watermarks, special colors or background designs, will not be as effective in the post-Check 21 world. Currently, black and white images are predominant, and some check stock security features may not survive imaging.

Review the implications of Check 21 with your fraud prevention teams. If you don’t already use Positive Pay, you might want to consider adopting this bank reconciliation service to enhance your protection against check fraud.

Review electronic options for managing your cancelled checks.

Cole Taylor can provide images of your paid checks on CD-ROM. With this option, you may be able to achieve greater efficiencies in your work environment. To learn more, contact the Cole Taylor Cash Management team at (312) 442-5070.

Check 21 aims to improve check-clearing efficiency by reducing the clearing system’s need to physically transport the original check from the point of deposit to the original paying bank.

Visit us at

www.coletaylor.com